Dynamic contract

Dynamic Contract (DYC) enables users to set the contract selection details while they create the strategy, based on which the system will select current relevant strikes. It simplifies the task of strike selection process which takes some time to be done manually.

Note

Dynamic contract is only applicable for creating strategies and not for creating scanners.

Steps for selecting a Dynamic contract¶

There are 3 simple steps to set a Dynamic Contract.

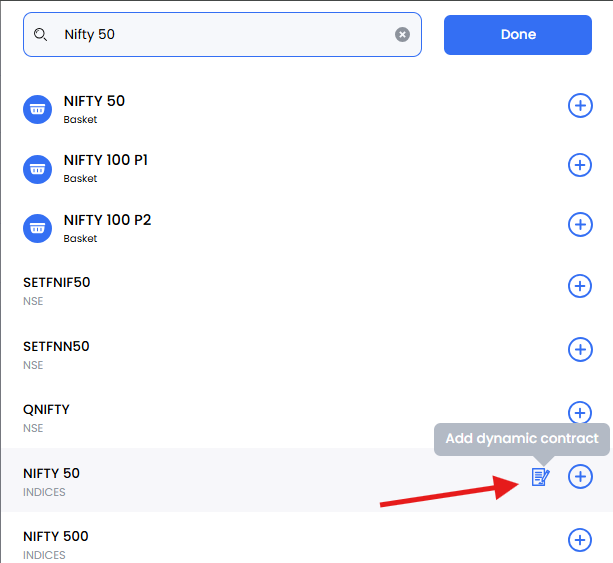

- Select an underlying. For example, Nifty 50 Indices in Create page.

- Hover on the underlying (here, Nifty), you will get a icon to convert it to a dynamic contract.

- Set the parameters for strike selection

Info

- Backtesting on expired contract data is available from 1st March 2020.

- For expired contract, conditions based on Options Greeks can be backtested for latest 3 months.

- For expired contract, conditions based on Open Interest can be backtested from 1st June 2021.

- For backtesting, the current day Dynamic Contract data gets updated by 9 PM on the same day.

Dynamic contract Parameters¶

Contract Type: You can select either Call or Put or Futures of the underlying

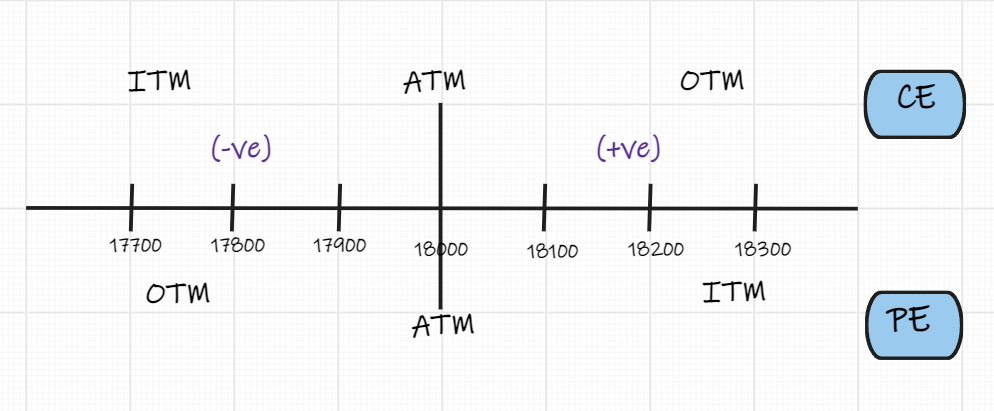

Offset: This enables users to set whether they want to trade using ATM, ITM, or OTM. Offset ‘0’ will select the ATM and Offset ‘2’ will select two strike prices above the ATM strike price and Offset ‘-2’ will select two strike prices below the ATM. The general rule for Offset in Dynamic Contract is negative(-) is Lower strikes and Positive(+) is Higher Strikes.

More on Offset

You can refer to the below image where the graph is divided into 4 parts. The region above the horizontal line is assumed as CE and region below the horizontal line is assumed as PE.

If the Current Market price of Nifty 50 is 18012 the ATM Strike price will be 18000 and the offset in Dynamic Contract (DYC) for ATM will be "0"

Now if you want to add four DYC contracts in your strategy namely, 17800PE, 17900CE, 18100PE and 18200CE. What offset should you keep, considering 18000 is ATM?

- 17800PE is considered as OTM and is four offsets towards the left of ATM. Hence, the offset assigned shall be -4.

- 17900CE is considered as ITM and is two offset towards the left of ATM. Hence, the offset assigned shall be -2.

- 18100PE is considered as ITM and is two offset towards the right of ATM. Hence, the offset assigned shall be 2.

- 18200CE is considered as OTM and is four offset towards the right of ATM. Hence, the offset assigned shall be 4.

Note

At the time of writing this, the Strike Interval for Nifty 50 options was 50 points.

Expiry: You can select whether you want to trade on the Current contract or the Next contract

Expiry Type: This enables you to select either Monthly contracts or Weekly contracts

Order Type: You can set whether you are Long or Short on the contract. This setting will always supersede the Strategy position i.e. Buy/Sell. This is because with Options you can short put and be bullish. Additionally, it enables you to create Spread, which may require you Long and Short on different contracts in the same strategy.

Change Frequency: This setting will determine how often you want the strike to be changed.

- Candle: This will choose the ATM/OTM/ITM strike price after every candle Close. The candle interval will depend on the base timeframe of the strategy.

- Day Open: This will choose the ATM/OTM/ITM strike price on the basis of the Day’s Open price. It will remain consistent throughout the day since Open will not change.

Usefull Links

You can also watch this webinar.