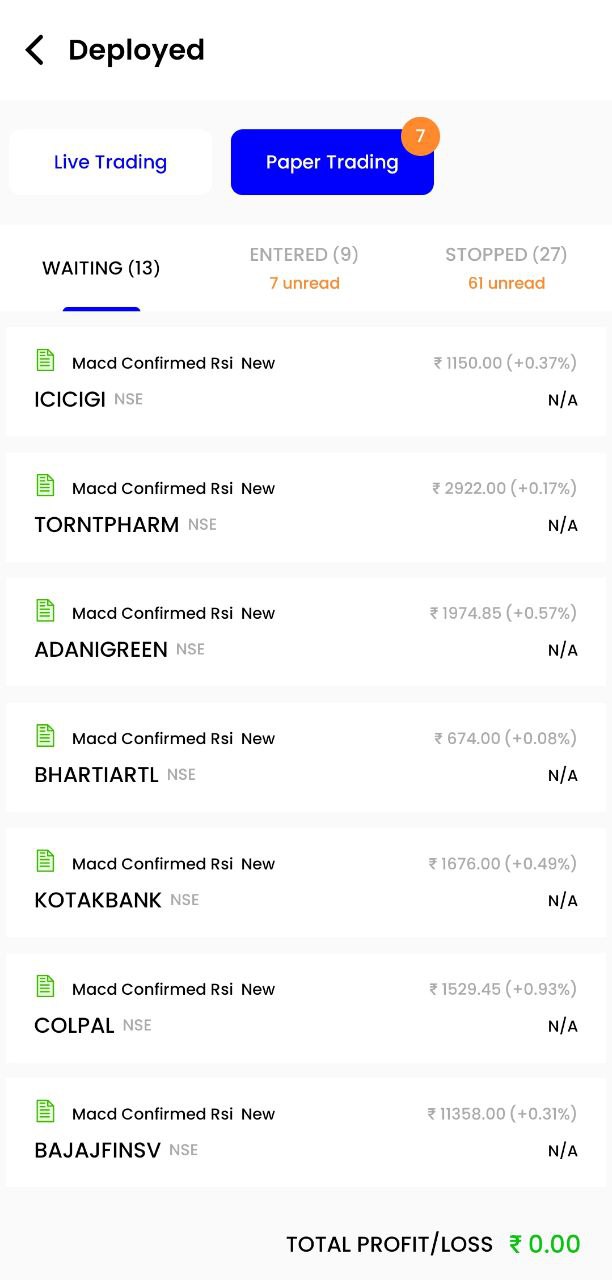

Deployed

Deploy allows users to take their strategies live in the stock market and get actionable alerts based on the entry and exit conditions in their strategy.

Deploy Count

You can have upto 100 concurrent strategies (with Ultimate plan) live in the waiting and entered state. This includes strategies deployed on paper trade and live trade. If you deploy one strategy which has 10 instruments inside it, the deploy count will reduce to '90/100'. Further, if you deploy five different strategies on one single instrument, your latest deploy count will be '85/100'. Indicating you now have 85 concurrent deployments left out of 100.

Streak does not calculate any margin requirement for you to take a position, all margin calculations is done at the moment you take a position by clicking on the order window.

The moment you click on confirm, the strategies gets deployed and you are moved to the Deployed section of Streak.

The deployed section has 3 different States of a strategy

- Waiting

- Entered

- Stopped

Waiting¶

Indicates the number of strategies you have deployed and the Streak system start tracking for signals. You can have as many as 30 live strategies in the waiting and entered section combined for the regular plan.

The moment a strategy ENTRY criteria is met a Blue or an Orange dot appears and starts blinking continuously.

- Blue dot - Buy (Entry buy) condition has met

- Orange dot - Sell (Entry Sell) condition has met

The moment you click on the blinking dot an order window is shown. You will have to click on the Buy/Sell button in order window to enter the position.

Now, if the order is completed then the strategy automatically moves to the Entered section.

Entered¶

Strategy in the entered state means you have an open position and this position has the SL and TP price mentioned.

As soon as your strategy moves to the Entered tab, you will receive an SL/SL-M notification, you can place the SL/SL-M order as well. This will allow users to exit immediately when the stock price reaches the Sl/SL-M level or below. Although this is optional, you can choose not to act upon the SL/SL-M notification.

Once you place the SL/SL-M do remember to cancel this open order if you exit your position by acting on the Target Profit or exit condition alerts

In case, you have not placed the SL/SL-M order, you shall receive a notification, the moment your TP or SL level gets triggered. You will be notified with blinking dots

- Red - Stoploss

- Green - Target profit

- Blue dot - Buy (Entry buy or Exit condition buy)

- Orange - Sell (Entry sell or Exit condition sell)

- Yellow - Place SL/SL-M order

SL-M order if placed earlier, will just close the position

Also, if your strategy has 2 or more cycles associated with it. The strategy waits in Entered after completing the first cycle.

Stopped¶

A strategy can move to stopped state if you have - Completed the strategy cycle, Strategy was manually stopped, Strategy gets terminated or force stopped.

Redeploy strategy¶

You can always Redeploy a stopped strategy anytime and it will move to Waiting state in the deployed section.

Force Stop strategy¶

The strategy can be stopped by the user at any time in the life cycle of the strategy by clicking on the two dots and then choosing "Stop" button. If the strategy has not entered a position, it will be directly stopped. If the strategy is in entered state and you click on Stop, the user will be presented with the below two options

A. Exit Positions Now - If you select this, you will be rendered with a orderbox to square off your current position, post placing the order, the strategy will move to stopped state.

B. Keep Position Open - This will keep the position open in your broker account, but will move the strategy to stopped state. And the strategy will not be tracked in Streak for further alerts.

After stopping the strategy, the deployed scrip will no longer be tracked and no further alerts will be sent to the user for the respective strategy.

Orderlog¶

You can view the complete details of strategy stages from the orderlog in the deployed page. Here you will be able to see order details including entry/exit time in orderlog.

Orderlog details for a trading session is only availble till midnight. You can download the CSV file before midnight to save the details.

Strategy cycle¶

A Strategy cycle consists of an entry followed by a respective exit of a strategy.

Once a strategy is deployed, the stocks are periodically tracked based on the conditions in the strategy. The periodicity with which the market is tracked is the same as the candle interval selected by the user while creating/backtesting the strategy and shown in the strategy summary before deployment. A strategy's ideal life cycle and the tree of events that can occur during a strategy's life cycle is explained below:

- Waits for the first entry event as per the conditions mentioned in the deployed strategy.

- Once the entry event occurs, an entry signal (buy/sell) is triggered and an actionable alert is sent to the user.

- The user can choose to act on the alert by clicking buy/sell button or choose to ignore the alert and cancel it.

- If the user has clicked on buy/sell button in the order window, a market order is sent to the exchange via your broker terminal.

- The order will either be successfully placed by the exchange or it might get rejected due to various reasons, such as insufficient capital.

- After the successful placement of an order (entry), an SL-M notification is sent to the user. This is optional. Choosing to ignore SL-M order notification will not stop the strategy.

- After an entry position is taken, the strategy continues to track the stock waiting for the exit signal (SL or TP) or exit condition. Based on the entry price and the SL and TP percentages entered by the user, the SL and TP prices are calculated which are displayed to the user, in the deployed page.

-

When the SL/TP price level is reached or if the exit condition is met, whichever occurs first, an actionable notification is sent to the user again. The user has to act on it by clicking buy/sell or choose to ignore the alert and cancel it.

-

If the user has clicked on buy/sell in the alert, a market order is sent to the exchange (NSE) and the strategy's cycle is now complete.

Important

If the SL-M order is placed the user will not get a subsequent SL notification. The position will be exited (by the SL-M order) as soon as the SL conditions are met.

Points to remember¶

- The "strategy cycle" sequence defined above is an ideal sequence and is subject to market conditions and user behavior. Based on the user's action or market conditions, the sequence might not completely occur in the same way as it is intended to, since this sequence may have been interrupted due to various reasons such as, the user stopping the strategy, order rejection by the exchange, network lag, network error etc.

- For both intraday and overnight strategies, the strategy cycle is defined by the user from 1 to 20. If you select 1 cycle then after 1 entry and the respective exit the strategy is completed and moves to the stopped state.

- Margins are not blocked till the user acts on the actionable alerts (buy/sell) and the order is sent to the exchange. Margins are blocked by your broker and not Streak. You can have 30 strategies/instruements in deployed - waiting state with zero margin blocked.

- The strategy can be stopped by the user at any time in the life cycle of the strategy by clicking on the "Stop" button. If the strategy has not entered a position, it will be directly stopped otherwise the user will be presented with an option to either 'stop the strategy by keeping the positions open' or to 'exit positions now and stop the strategy'. After stopping the strategy, the deployed scrip will no longer be tracked and no further alerts will be sent to the user for the respective strategy.

- In cases where the user stops the strategy and chooses to keep positions open, the responsibility of closing any and all positions is solely on the user, and the user will get no alerts for that deployed instrument once the strategy is stopped.

- For order type MIS, all strategies will be stopped at 3:20 pm and the open positions, if any, will be squared off by the respective brokers (example, Zerodha, Angel Broking) before market close and 4.30 PM for currency futures

- All actionable order alerts sent to the user can be used only once and will be active for only 5 minutes (in the notification bell icon) after which the alert expires in the alerts/notification section. However, the alerts can still be acted by clicking on the take action button to enter the strategy on the deployed page.

- All actionable alert orders are market orders (can be changed to Limit) and users can expect price variation from the price at which the alert was triggered to the price at which the order is placed. This is called Slippage. The slippage for ill-liquid intruments is usually high.

- If the user's order is rejected due to various reasons such as shortage of funds, circuit limit hit, no liquidity in the market, etc, the strategy will be stopped and no further alerts will be sent for that strategy. This is done in order to avoid unnecessary tracking of instruments where the order placement failed. However, the user can deploy the strategy again and take action on any new alerts that get generated.

- As a precautionary measure system prompts the user to place an SL-M order immediately when they take a position. This is to bring in discipline while trading. The user can place the SL-M order or cancel it. In case the SL-M is not placed, the position will still be live and if the stop loss is hit first then SL order notification is sent to the user for their action to close the position.

- Target profit orders are not placed with the entry order. The strategy tracks the insturment for the stop loss and target profit prices only after entering a position. Once the stock price reaches TP level, an actionable alert is sent to the user. Once the user confirms the order, the exit market order is placed and the position is closed. You will have to cancel the SL-M order by clicking on cancel SL-M, if you had placed SL-M when you entered the position.

Disclaimer¶

- Once a signal is generated, we try to send this signal to the user's device over the internet. The delivery of these alerts are subject to network conditions of the user, internet services and technical issues.

- Accurate and complete real-time price data is critical for the success of trading in the capital market. Our service providers or systems that provide data could experience failures, errors, lag and latency, which could result in missing, incorrect, or stale market data leading to no/wrong signals (alert) while triggering an alert.

- By using this service, the user acknowledges they understand that the alerts' delivery is dependent on many factors such as the internet connection of the user, location, time of the day, server load, data availability, etc.

- We advise users to be logged in to streak.tech, keep it open in their browser and maintain an uninterrupted fast internet connection to their devices to see the best alerts delivery.

- Streak relies on third-party services for market data, eg: ticks, OHLCV, etc. If these services are down due to unforeseen circumstances or experience a downtime due to various technical / non-technical issues, Streak might not be able to generate and deliver the actionable alerts.

- All actionable order alerts are read-only order alerts, where with a single click the user can send the order to the exchange. The actionable order alerts are made read-only in order to obtain consistency in the deployed and backtest results and to avoid any drastic increase in risk.

- Upon clicking on Buy/Sell button on the order window, based on users network speed, there can be network latency, and any rapid clicks on the Buy/Sell button through the same or different windows can lead to multiple order placements. Users take full responsibility on making sure the actions on the notifications are their own actions and are fully aware of their positions and strategy status when on the Buy/Sell button.

- When deploying a strategy, the look-back period for which the data is fetched to calculate indicator values and generate entry/exit triggers depends on the candle interval of the strategy. 1 minute checks for signals on minute candles with a maximum allowed window of 30 days. 3 minute to 30 minutes checks for signals on the respective candles based on data availability with a maximum allowed window of 90 days. 1 hour candle checks for signals on an hourly candle with a maximum allowed window of 1 year based on data availability. 1 day candle checks for signals on a day candle with a maximum allowed window of 5 years based on data availability.

- All MIS strategies deployed on Streak, for Equity and Equity F&O will expire at 3:20 PM, for MCX it will expire 25 minutes before the market closing time and for CDS it will expire at 4:30 PM. And no further alerts will be tracked for that day. Open positions, if any will be squared off by the broker RMS system as per their square off time.

- Streak does not calculate any margin requirement for you to take a position, all margin calculations is done at the moment you take a position by clicking on the order window.

- While verifying the entry conditions, quantity freeze is not consisdered. A trigger will be generated even when the quantity is higher than Freeze quantity (maximum quantity for a buy/sell order set by the exchange).