Discover

Discover allows users to access more than 120 backtested sample strategies to get started with. You can view the performance of curated top-performing strategies across sectors and also deploy them instantly

Using the new category and filter feature, you can filter strategies based on timeframe, chart type, indicators, and position. Whether you want strategies based on overlay studies, momentum, pivot point, price action, option strategies or chart patterns, you can use the filters to find the choice of your strategy in a minute.

Overlays: Overlay studies are displayed over the main price chart and include the following indicators- Moving averages(sma, ema, dema, tema, wma, tma), Bollinger bands, Parabolic SAR, Supertrend, VWAP, alligator and ichimoku.

Momentum: Momentum can be defined as acceleration or deceleration of the rate of change of price. Momentum indicators are useful for volatile market and include Relative Strength Index, ADX, Aroon, MACD, CCI, MFI, Willams %R, TRIX, PROC, MOM, Stochastic, TII and Chande Momentum Oscillator

More on Momentum

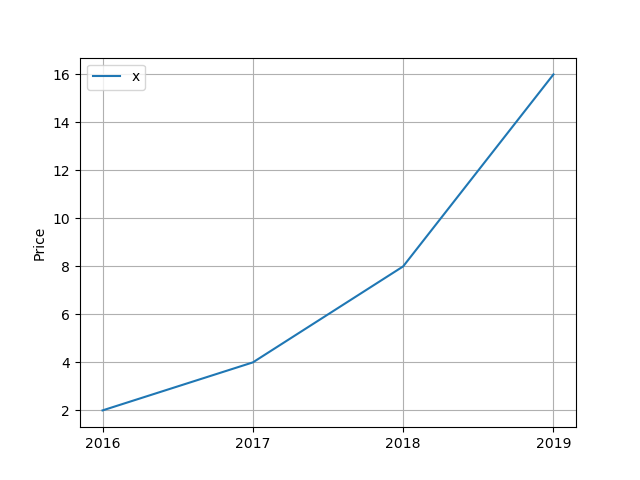

Example: The company's price changed from INR 2 in 2016 to INR 4 in 2017. The rate of price change increased from INR 4 in 2017 to INR 8 in 2018 and so forth.

Volume: These indicators account for volume data in their calculation and include OBV, Volume, Opening Range Volume and Moving Average Volume

Volatility: Volatility indicators measure how risky the current market is but does not determine a direction. In Technical Analysis, volatility is measured by True Range, Average True Range, Natr and vortex indicators.

More on volatility

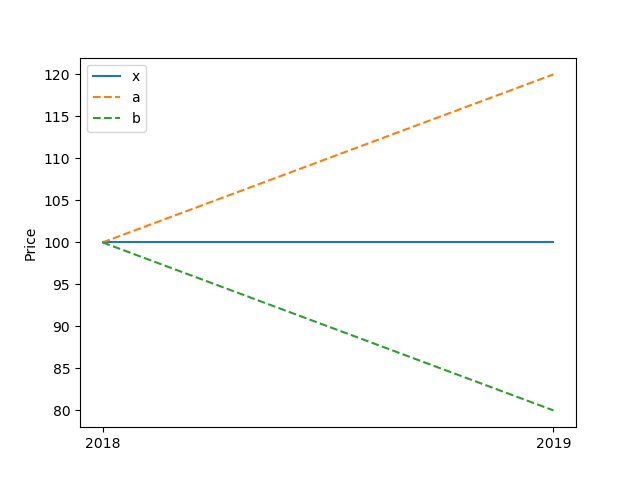

Example: Company X has annualised volatility on 20%. It means after a year the current price INR 100 can go up by 20% to INR 120 or come down by 20% to INR 80.

'a'represents the price line in case the stock goes up. Similarly, 'b' represents the price line in case the stock goes down.

Price action: Price action is the movement of a security's price plotted over time and is indicated by the following indicators Opening range, Close, Open, High, Low, Pivot, Narrow range and Nth Candle.

Chart Patterns: The following candlestick chart patterns are currently supported- Morning Star, Spinning Top, Homing pigeon, Three while soldiers, Abandoned baby, Concealed baby, Stick sandwich, Engulfing, Kicking, Tri star and Advance block pattern.

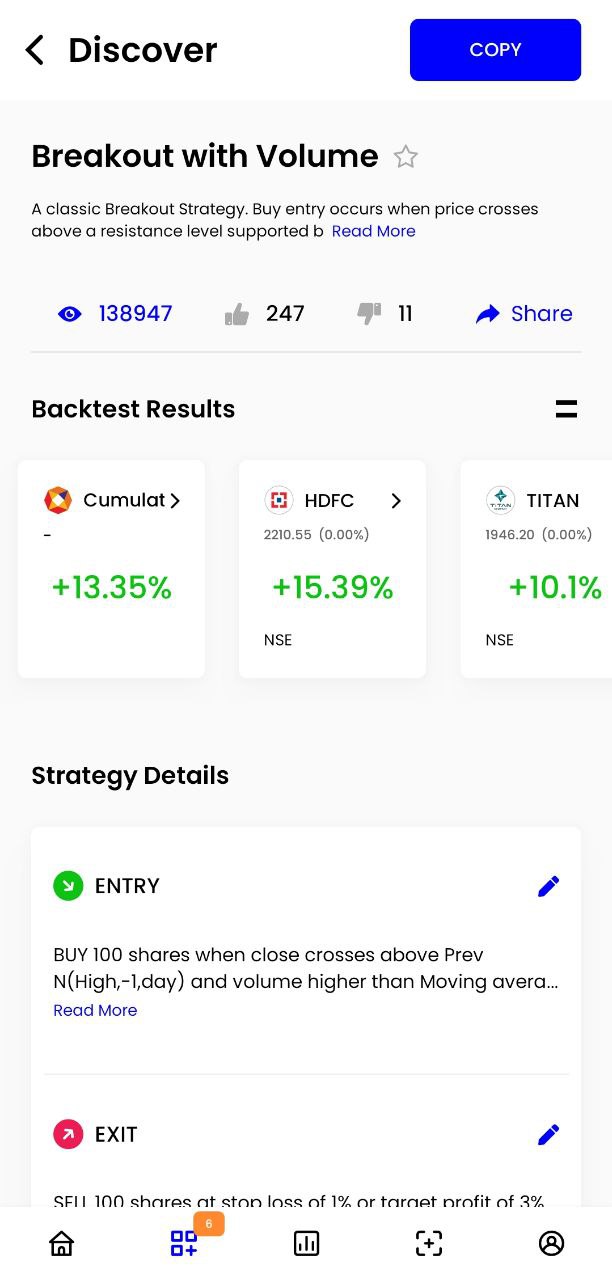

Strategy Snapshot¶

You can now view the performance of a strategy on each instrument without opening the backtest result. This will enable you to go through major information about the strategy quickly, like Cumulative Profit/Loss, number of symbols, Last traded price(LTP), and profit/loss of each symbol. You can also read the strategy description to know more about the strategy.

If you want to view the whole backtest result, you just have to click on the strategy description. To know the process of deploying a discover strategy, you can refer to this.

The backtest result gets refreshed every single day to portray the performance in current market conditions and mentioned time frames.

Important

Please note that these strategies are meant for inspiration and are not to be construed as recommendations. You can modify these strategies anyway you like before taking it live.